Apologies - the Brisbane event is now full. Livestream tickets still available

Strategic Insights - Portfolio Management for Managed Accounts in the "new Normal"

The COVID-19 pandemic is creating turbulence in global financial markets with portfolio managers grappling with the issues brought about by government intervention intended to avoid economic catastrophe both here and overseas.

In 2021 at our first live conference, the IMAP Portfolio Management Conference, our industry experts will delve into the practicalities in making investment choices in the context of the current global market backdrop.

As in previous years, the IMAP Portfolio Management Conference will be split into 2 parts. In Sydney we will focus on Asset Allocation and in Brisbane the focus will be Security Selection.

Sydney 23 Feb 2021 – face to face in person

Brisbane 2 Mar 2021 – face to face or live streamed

Perth – deferred to 1 Jun 2021, subject to open borders

Strategic Insights - Portfolio Management for Managed Accounts in the "new Normal"

The COVID-19 pandemic is creating turbulence in global financial markets with portfolio managers grappling with the issues brought about by government intervention intended to avoid economic catastrophe both here and overseas.

In 2021 at our first live conference, the IMAP Portfolio Management Conference, our industry experts will delve into the practicalities in making investment choices in the context of the current global market backdrop.

As in previous years, the IMAP Portfolio Management Conference will be split into 2 parts. In Sydney we will focus on Asset Allocation and in Brisbane the focus will be Security Selection.

Sydney 23 Feb 2021 – face to face in person

Brisbane 2 Mar 2021 – face to face or live streamed

Perth – deferred to 1 Jun 2021, subject to open borders

Brisbane 2nd March 2021

Brisbane 2nd March 2021 -

Brisbane Programme

2 March, QUT Gardens Point Campus CBD

8.45am Opening address

Toby Potter IMAP Chair and our MC Alan Logan, Marcona Partners

8.55am International Shares

- Current market valuations

- Emerging vs developed market

- Realistic market return expectations

- What impact on market returns will derive from medium term macroeconomic influences in a lower for longer world?

- Is this all just rate driven revaluation?

Amanda Munro of IMAP

Charles Stodart of Zurich

Francyne Mu of Franklin Templeton

Monik Kotecha of InSync

9.45am The role of real assets and infrastructure in a portfolio

- How best to access this type of investment for retail / managed account investors

- How to assess infrastructure managers Global vs Australia exposure

- Role of this type of asset in goals based portfolios

- How have infrastructure investments been affected by recent market volatility Illiquidity?

Greg Pease of Evidentia

Jan de Vos of Resolution Capital

Stephen Hayes of First Sentier

10.35am Morning Break

10.55am ESG and the role of the Adviser Part 1

- Karen McLeod of Ethical Investment Advisers will moderate a panel of presenters from leading organisations - Macquarie and Australian Ethical - who will provide the tools that Advisers need to implement ESG decisions.

- Application of ESG and Ethical Framework within portfolio construction

- ESG and Ethical investment without compromising returns

- The common misconceptions of investing with an ESG and Ethical lens

- Stock examples and alpha generation

- How to take a total portfolio approach to Sustainable Investing

- Sustainability in Liquid Alternatives

- How to talk to clients about Responsible Investing – from ESG integration to Impact

Presenter(s)

Karen McLeod of Ethical Investment Advisers

Dan Powell of Nanuk Asset Management

Jason Todd of Macquarie

Leah Willis of Australian Ethical

11.40am Alternatives

- Selecting alternative managers

- The key roles that alternatives can play in portfolio construction

- Will they perform better in the next two years than they have in the past two,

- Is real estate an Alternative Private equity – a real opportunity for retail investors?

Toby Potter of IMAP

Angela Ashton of Evergreen Consultants

Alex Donald of Ironbark

Steven Tang of Zenith

12.30pm Lunch Break

1.25pm What do zero rates mean?

Charlie Jamieson of Jamieson Coote Bonds will share his views on;

• The interest rate outlook - Domestic and Global

• Risk of Inflation

• Whether zero rates are leading the equity markets to delude themselves

• Opportunities in parts of the Fixed Interest market

• Fixed interest investments forming part of the income objectives in a portfolio

Presenter(s)

Charlie Jamieson of Jamieson Coote Bonds

1.55pm Do Managed Accounts Work?

Using a real life example from the current COVID 19 market crisis and extensive quantitative modelling, this session discusses proof that managed accounts offer better outcomes for clients. Toby Potter of IMAP will moderate a panel of experts to compare actual experience of managed accounts compared to unit trusts or adviser implementation;

• Does trading implementation matter?

• What is a typical timetable for rebalance using an MDA service? How much delay is there, if any?

• Is there a best interest dimension here?

• How varied have model managers been in their approach to the current market crisis?

Presenter(s)

Toby Potter of IMAP

Brett Sanders of Philo Capital

Jason Komadina of MLC

Rob De Silva of SQM Research

2.35pm Ex20 Australian Equities - Beyond the Behemoths

What are the opportunites in the mid cap, small cap and micro cap universe? How do they add value and how can Advisers talk about them?

Brad Partridge of Macquarie and Justin Woerner of Elston will provide their insights into how Ex 20 stocks can effectively be included in a Managed Account portfolio.

Moderated by Stephen Furness of MGD Wealth, join us on 2nd March at QUT in Brisbane to hear more about the Macquarie and Elston investment philosophies and processes - both Quantitative and Systematic.

Stephen Furness of MGD

Brad Partridge of Macquarie

Justin Woerner of Elston

3.20pm Afternoon Tea

3.35pm ESG and the Role of the Adviser - Part 2 Interactive Session with Audience

Presenter(s)

Karen McLeod of Ethical Investment Advisers

Dan Powell of Nanuk Asset Management

Jason Todd of Macquarie

Leah Willis of Australian Ethical

4.15pm Conference closing remarks and networking drinks

Sydney Programme

This conference was held on 23rd February, Dockside Darling Harbour

8.45am Opening Address

8.55am The Key Questions to ask your Fixed Income Manager

Chamath De Silva will discuss BetaShare's approach to optimising the traditional goals of income, diversification and capital preservation in a defensive portfolio under current conditions.

- With fixed income markets trading at rates close to zero if not in negative territory does this change the role fixed income will play in defensive portfolios?

- What are the pitfalls of new fixed income strategies that investors need to understand

- How to invest for fixed income – direct vs ETF vs managed fund

- What are the pros and cons of each investment vehicle?

Presenter(s)

Chamath De Silva CFA of BetaShares

9.25am The Challenges of Building Managed Account Programs for Larger Advice Businesses

- Dealing with multi platform environments

- Accomodating adviser perspectives

- Providing continuity for existing portfolios

- Reporting

- Using scale for the benefit of clients

- Supporting advice practices which "have their own ideas"

Angela Ashton of Evergreen Consultants

Justin McLaughlin of ClearView

Martin Crabb of Shaw & Partners

Paul Saliba of AMP

10.10am How Central Bank Policy and GeoPolitical Stresses will affect Investment Markets

Change in globalisation patterns. What are the implications for markets? Given China’s geopolitical ambitions, what does it means for markets? What will be the legacy of QE and implications for inflation? Lower for longer interest rates - what does mean for portfolios?

Presenter(s)

Nigel Douglas of Douglas Funds Consulting

Jesse Imer of Mason Stevens

Jonathan Baird of Western Asset

10.55am Asset Consultant Session 1

Presenter(s)

Chris Lioutas of Insight Investment Consultants

11.10am Morning break

11.30am A new investment order

Given lower for longer rates can any portfolio achieve higher growth rates? With markets at heady highs are falls more likely than rises in equities? If the traditional 60:40 portfolio is completely defunct, what does this mean for the 80:20 growth portfolio?

Hear James Kingston of BlackRock discuss;

• Where CPI is expected to go

• General long term capital market assumption views

• Investment product selection

• Diversification away from traditional asset classes

• Whether CPI + portfolios will meet their objectives

Presenter(s)

James Kingston of BlackRock

12.00pm AA challenges and features in Managed Accounts

Al Clark of MLC and Piers Bolger of Viridian Advisory/Infinity Asset Management tackle the issues of resourcing, team construction and processing of Asset Allocation changes in Managed Accounts.

• What will be the big Asset Allocation decisions in Q1 2021

• The impact of low interest rates on investment portfolios

• How to cater for overvalued traditional asset classes

Moderated by Michael Karagianis of JANA Investment Advisers, this session will delve into the practicalities faced by many Licensee Portfolio Managers.

Presenter(s)

Michael Karagianis of JANA

Al Clark of MLC

Piers Bolger of Infinity Asset Management/Viridian Advisory

12.45pm Asset Consultant Session 2

Presenter(s)

Brad Matthews of BMIS

1.00pm Lunch break

2.00pm Best vehicles for achieving managed account portfolio objectives

Managed accounts aren't exclusively listed securities, increasingly other security types such as ETFs or LIT are included. Given the range of investment vehicles available what are the benefits and disadvantages of each?

Apart from price, when should a portfolio manager choose active over beta exposure?

Presenter(s)

Dominic McCormick

Chris Meyer of Pinnacle

Evan Metcalf of ETF Securities

Nathan Lim of Morgan Stanley

2.45pm Retirement Incomes

Constructing managed account portfolios for pension clients, Meeting income objectives in this environment, avoiding sequencing and downside risk for people who can't recover, incorporating illiquid assets into managed account portfolios

Presenter(s)

Matt Olsen of IOOF

Andrew Lowe of Challenger

Lukasz de Pourbaix of Lonsec

Victor Huang of Milliman

3.35pm Afternoon Tea

3.50pm Asset Consultant Session 3

Presenter(s)

Jerome Lander of Dynamic Asset Consulting

4.05pm Where we are looking for Growth in 2021?

Asset Consultants cover their main thesis for portfolio construction for a growth portfolio

Presenter(s)

Alan Logan of Prior Family Foundation

Brad Matthews of BMIS

Chris Lioutas of Insight Investment Consultants

Jerome Lander of Dynamic Asset Consulting

4.35pm Conference closing remarks and networking drinks

Our talented and interesting presenters will challenge and inform you

Chamath holds a Bachelor of Commerce (Hons) from University of Melbourne and is a Chartered Financial Analyst (CFA)

Adviser Registrations

- Please register for your preferred venue using the Registration button above:

- Advisers registrations for individuals and groups

- Get access to all sessions

- Free conference app

- Special IMAP Dealer group / Licencee Subscriber discount

- Access to all Presentations / Videos

Corporate Registrations

- Please register for your preferred venue using the Registration button above:

- Corporate registration for individuals and groups

- Get access to all sessions

- Free conference app

- Discount for IMAP Corporate Subscribers

- Access all Presentations / Videos

BOOK A TABLE FOR 8 PEOPLE

- Premium table location at the venue

- Bring your guests and colleagues

- Standard table seats 8 people

- Build your brand profile

- Call Jane McIlroy P: 0411 420 180

- E: jane.mcilroy@imap.asn.au

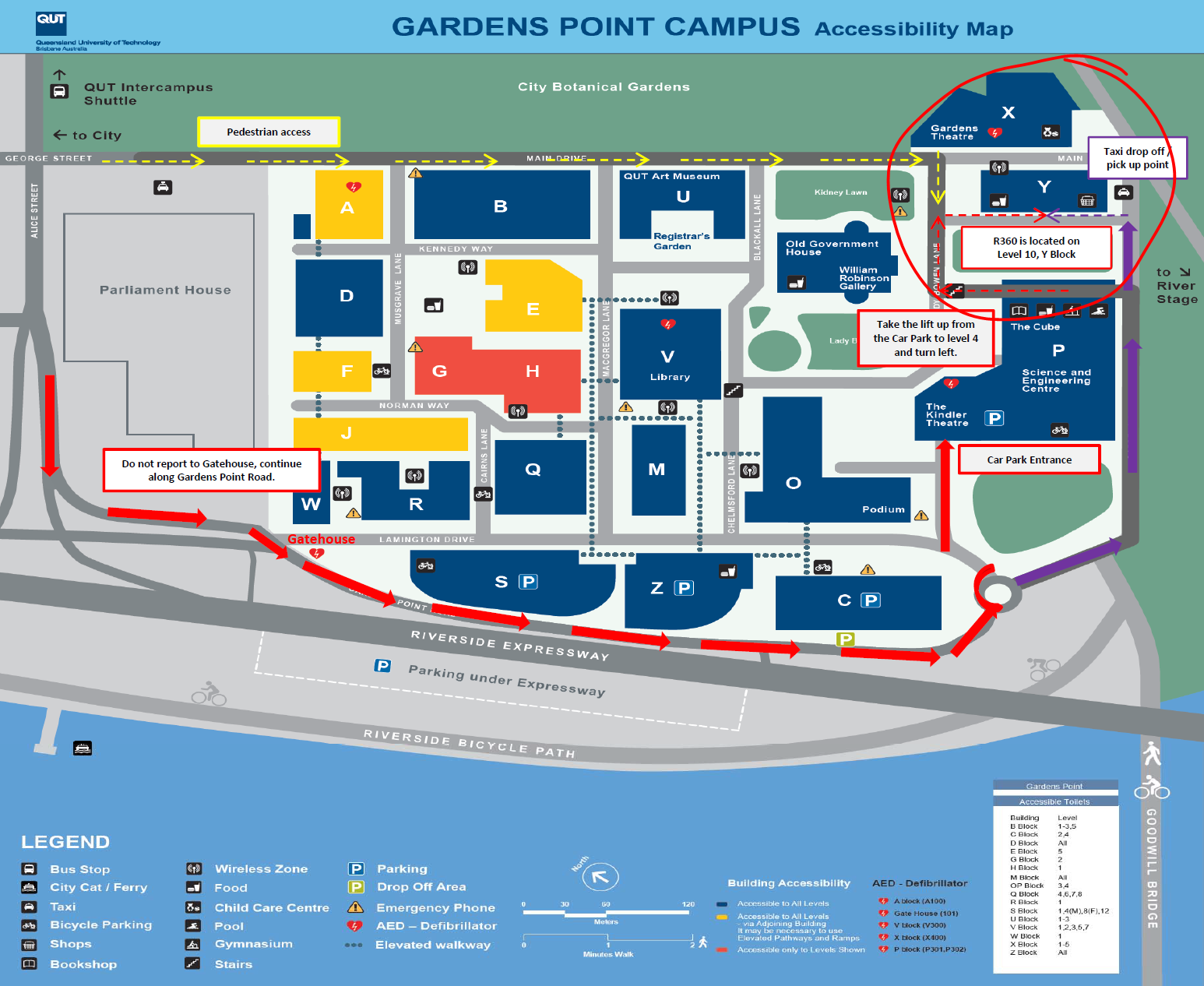

Venue Information for IMAP's Portfolio Conference 2020 being held in Sydney and Brisbane

Venue Details - BRISBANE QLD 2 March 2021

IMAP's Portfolio Management Conference 2021 is being held at Queensland University of Techlnology in Brisbane

Room Three Sixty is a contemporary top-floor venue atop QUT's world-class Science and Engineering Centre, with incomparable panoramic views of the city skyline from one of the most picturesque corners of Brisbane city. Flexible and designed to impress, Room Three Sixty features floor-to-ceiling windows, two adjoining open-air terraces, and a full-service bar and informal lounge area.

Award-winning boutique catering company Cuisine on Cue are the exclusive caterers for Room Three Sixty

Contact details for the venue can be found on their website

https://www.venuecollection.qut.edu.au/venues/room-three-sixty

Event Venue's Address:

Queensland University of Technology

QUT Gardens Point Campus

Room 360, Y Block

Garden Point Rd,

Brisbane QLD 4001

Covid Safety Plan for QUT Conference Venue

COVID safe declaration:

This event site operates under a COVID plan based on the Industry Framework for COVID Safe Events in Queensland – QLD Tourism Industry Council, the COVID-19 SAFETY PLAN – Restaurant and Catering, Organising an Event Fact Sheet and The Queensland Government’s Road Map to Easing COVID-19 Restrictions

Meet the IMAP Events Team

IMAP Events Team Contact Details for Portfolio Management Conference 2021

Please contact the IMAP Event team with any queries:

Email Address: support@imap.com.au

Phone: +61 2 8003 4147